does nc have sales tax on food

At a total sales tax rate of 675 the total cost is 37363 2363 sales tax. Food is exempt from the State portion of sales tax 475 but local sales taxes Articles 39 40 and 42 do apply to food to make up a 2 sales tax on food.

64 Dollar Grocery Budget Harris Teeter Grocery Budgeting Harris Teeter Budget Food Shopping

Bakery items unless sold for consumption on the premises ie.

. You own a grocery store in Murphy NC. We include these in their state sales. This page describes the taxability of food and meals in North Carolina including catering and grocery food.

Heart of the matter. Are groceries taxable in North Carolina. Exceptions include localities in.

53 rows Table 1. North Carolina doesnt collect sales tax on purchases of most prescription drugs. To learn more see a full list of taxable and tax-exempt items in North Carolina.

The transit and other local rates do not apply to qualifying food. Groceries and prepared food are subject to special sales tax rates under North Carolina law. Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax.

A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. Does North Carolina have sales tax on food. A customer living in Cary North Carolina finds Steves eBay page and purchases a 350 pair of headphones.

We would like to show you a description here but the site wont allow us. Truth be told food tends to. Candy however is generally taxed at the full combined sales tax rate.

B Three states levy mandatory statewide local add-on sales taxes. 31 rows The state sales tax rate in North Carolina is 4750. With cutlery are exempt from the state tax and only have to pay the local 2 tax.

In most states necessities such as groceries clothes and drugs are exempted from the sales tax or charged at a lower sales tax rate. Food Tax The 2 Food Tax is charged on retail sales and purchases of. But North Carolina does charge the 2 or 225 percent local sales tax on qualifying food exempting food purchases only from the statewide sales tax and the transit tax.

In other states sales tax laws regarding takeout or delivery food are different than the rules for on-site consumption. North Carolina has some exemptions for food items. Vitamins and supplements would qualify as tangible personal property which is taxable unless further ruling.

Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. With local taxes the total sales tax rate is between 6750 and 7500. Select the North Carolina city from the list of.

Three states Alabama Mississippi and South Dakota continue to apply their sales tax fully to food purchased for home consumption without providing any offset for low- and moderate-income families. Why does North Carolina require sales tax on vitamins and supplements. This general rate applies to food prepared and consumed on the premises of full service restaurants and other retail establishments such as taverns and fast food shops that serve food.

In North Carolina grocery items are not subject to the states statewide sales tax but are subject to a uniform 2 local tax. Items subject to the general rate are also subject to the 225 local rate of tax that is levied by all counties in North Carolina. When calculating the sales tax for this purchase Steve applies the 475 tax rate for North Carolina plus 2 for Wake Countys tax rate and.

South Carolina Unprepared food that can be purchased with federal food stamps is exempt from state sales and use tax but may be subject to other local sales and use taxes. Delaware has no sales tax and does not allow cities or counties to assess any type of sales tax. 35 rows Sales and Use Tax Rates Effective October 1 2020.

A customer buys a toothbrush a bag of candy and a loaf of bread. Does Wyoming charge sales tax on vehicles. The Article 43 half-cent Transit Tax and Article 46 quarter-cent county sales tax do not apply to food.

North Carolina has recent rate changes Fri Jan 01 2021. The sales tax rate on food is 2. Local governments which in many states levy their own sales taxes usually exempt food if food is exempt at the state level.

Grocery items are taxable but taxed at a reduced rate of 175. Some examples of items that exempt from North Carolina sales tax are prescription medications some types of groceries some medical devices and machinery and chemicals which are used in research and development. Sales taxes are not charged on services or labor.

Non-Qualifying Food Dietary Supplements Food Sold Through a Vending machine Prepared Food Certain Bakery Items Soft Drinks Candy. In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being sold to a consumer. In North Carolina grocery items are not subject to the states statewide sales tax but are subject to a uniform 2 local tax.

Make Your Money Work A number of categories of goods also have different sales tax rates. California 1 Utah 125 and Virginia 1. The Wyoming Emergency Sales Tax Act of 1935 imposed a two percent 2 sales tax on the retail sale of tangible personal property meals and cover charges and admission and amusement charges.

The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. It says that the NC state legislature passed a bill last year pretty much to clarify previous tax code since different retailers were acting differently.

Www Dornc Com Nc Farming Tax Farm Farmer Tax

Pin By Alexa On Life Hacks Poster Movie Posters Life Hacks

Alcohol Taxes In The U S And Around The World Infographic Zone Pinterest Alcohol

Where Your State Gets Its Money State Tax How To Get States

Green Cone Food Waste Digester Composter Etsy Composter Food Waste Thermal Heat

Enjoy Our Arepas Fresh Off The Grill Get Yours Today 8 1 Lunch Locatio Food Truck Arepas Lunch

Understanding Sales Tax With Printify Printify Sales Tax Understanding Tax Exemption

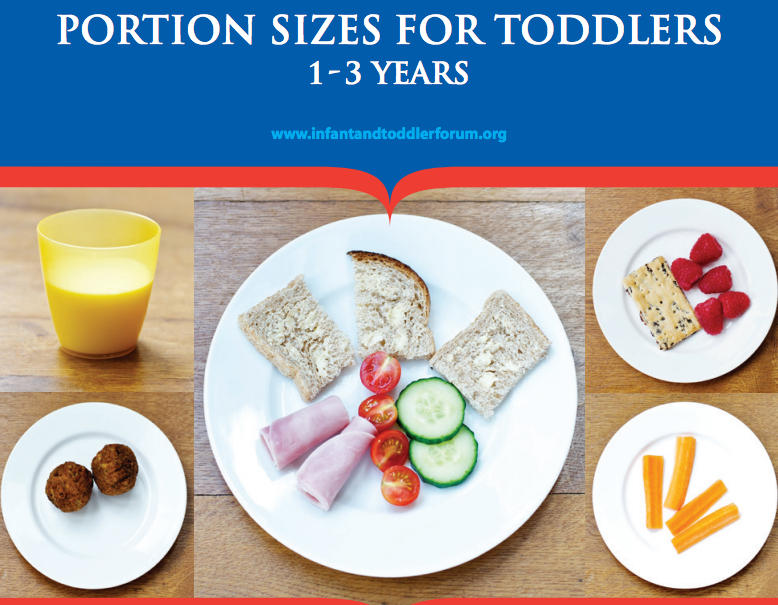

Portion Sizes For Toddlers 1 3 Years Because Nutrition Is Also A Part Of Their Learning And Exploration Toddler Nutrition Kids Nutrition Baby Food Recipes

Pin On Favorite Fast Food Places Fast Food

Stoneware Angel Plate Traditional Pottery Pottery Stoneware

Tax Deductions For Food Bloggers Blog Taxes Deduction Food Blogger

Charlotte S Queen S Feast Restaurant Week Jan 20 29 Feast Restaurant Restaurant Week Feast

Do You Want To Know Which Food Items You Should Avoid Giving To Your Dog Click Here To Know More Pet Food Delivery Food Animals Food

Map Of States That Do Not Tax Retirement Income Distributions Retirement Retirement Income Retirement Money

Do You Know The Deduction For Meals Meals Breakfast Lunch Dinner Healthy Eating