owe state taxes from unemployment

The tax you owe on your unemployment benefits might be minimal depending on how much you received. The unemployment exclusion specifically said you didnt have to pay taxes on the first 10200 of unemployment compensation drawn in the year 2020.

New Yorkers Face Steep State Taxes On Unemployment Benefits

Unemployment Insurance UI tax and Employment Training Tax ETT are calculated up to the UI taxable wage limit of each employees wages per year and are paid by the employer.

. Ad two states only tax a portion of unemployment benefits Indiana and Wisconsin. Previous Owed Taxes Can Cost You. In every other state unemployment benefits are treated as regular income.

The last thing most people want or need is to get audited. If you did not pay enough taxes on your unemployment during the year you may have to pay additional taxes on it when you complete your tax return. To minimize what you owe take.

Please contact us today by calling 410 727-6006 or completing this brief. The law waives federal income taxes on up to. You can find the amount you withheld during 2020 in Box 4 on the 1099-G tax form you shouldve received from EDD.

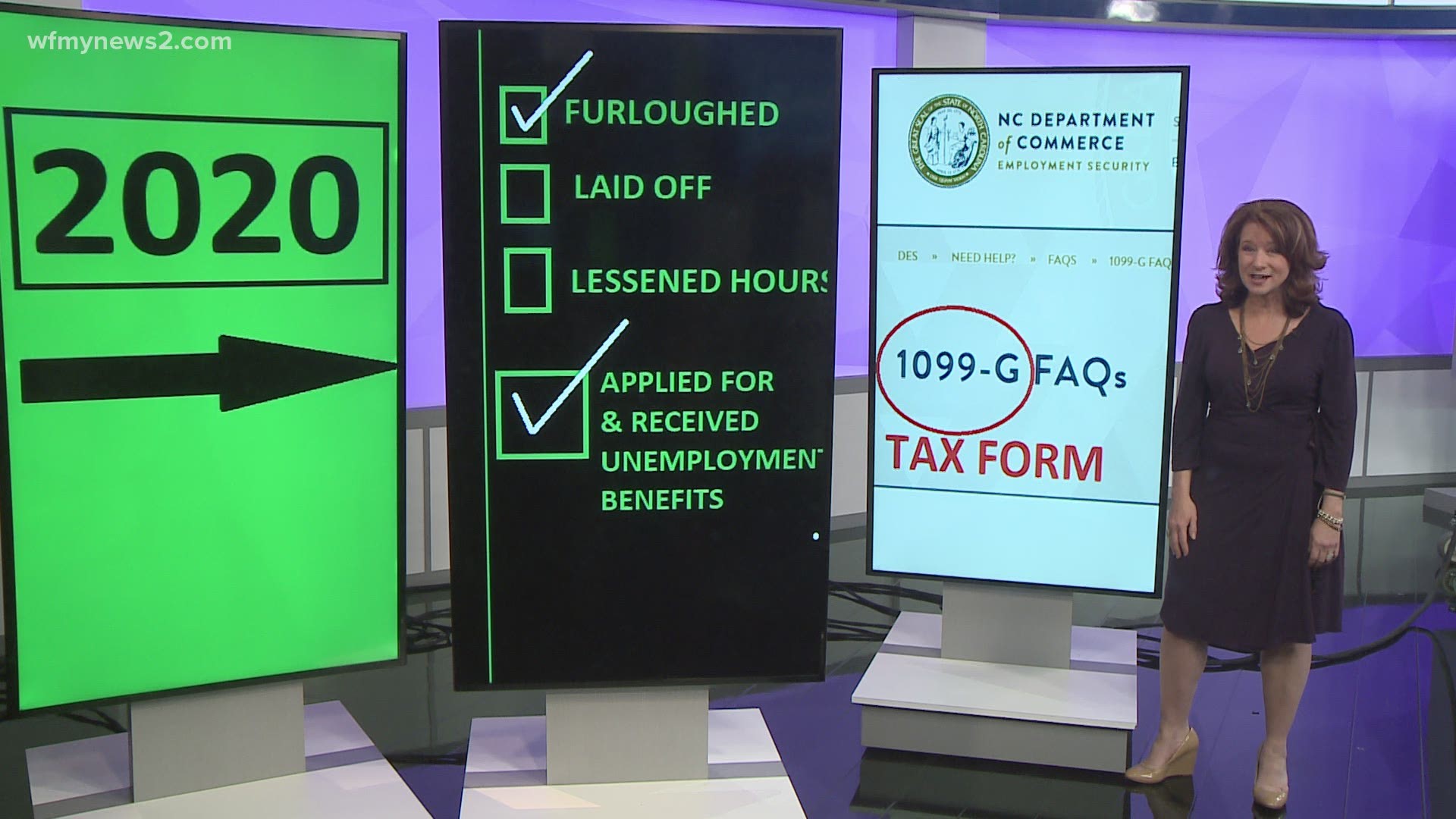

If youre struggling with tax liabilities or any other tax-related issues right now were here to help. Unemployment benefits are taxable so government agencies must send a tax form known as a 1099-G to people who received the benefits so they can report the. The 19 trillion American Rescue Plan signed into law last week includes a welcome tax break for unemployed workers.

Up to 20 cash back If you collected unemployment benefits in 2009 the last thing you need in 2010 is to end up paying too much in federal income tax. The American Rescue Plan Act of 2021 changed the tax code so that the first 10200 of unemployment benefits you received in 2020 is free of federal taxes. This is because unemployment doesnt replace 100 of your.

The IRS considers unemployment benefits taxable income When filing this spring your unemployment checks from 2021 will be counted as income taxed at your regular. If you didnt withhold anything youll have to pay any taxes. January 27 2021 753 AM.

If you owe previous taxes the IRS might already be looking at your file.

Filing Your Taxes If You Claimed Unemployment Benefits What To Know Where To Find Help Kqed

How To File Taxes If You Received Unemployment Benefits Zdnet

Texas Is Underfunding Unemployment To Keep Business Taxes Low Now It Owes 7 Billion And Counting Tpr

I Understand That Subsidies Come In The Form Of Tax Credits But I M Unemployed And Probably Won T Owe Any Taxes How Would The Subsidy Help Me Healthinsurance Org

You Have To Pay Taxes On Unemployment Checks What You Need To Know

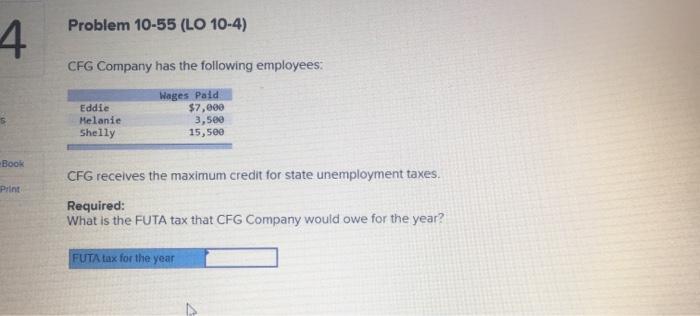

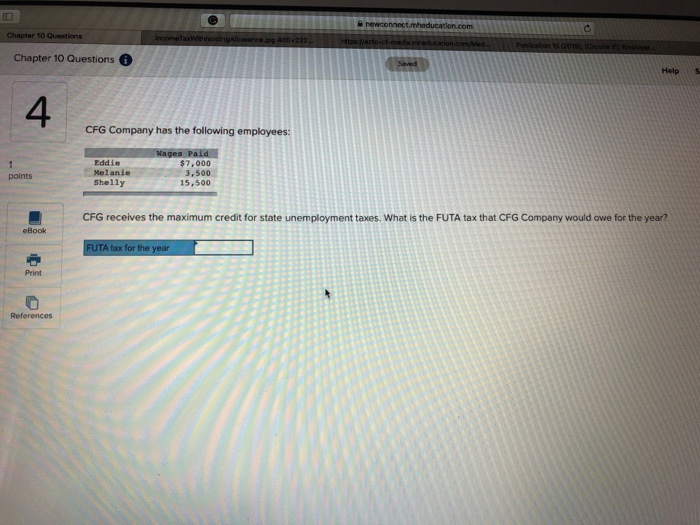

Solved Problem 10 55 Lo 10 4 4 Cfg Company Has The Chegg Com

The Case For Forgiving Taxes On Pandemic Unemployment Aid

Top Questions And Answers About Unemployment In Washington State King5 Com

What Is A 1099 G Form And What Do I Do With It

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

I M Unemployed And Owe Back Taxes What Should I Do Wiztax

Unemployment Benefits Are Taxable Look For A 1099 G Form Wfmynews2 Com

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Federal Covid Relief Includes Tax Break On Unemployment But Nc Sc Law Doesn T Comply Wcnc Com

Solved Chapter 10 Questions Help S 4 Cfg Company Has The Chegg Com

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back